Mastering PAYE Software UK A Business Guide

Mastering PAYE Software UK A Business Guide

Running a business in the UK demands precision. Payroll management sits at its core. Navigating tax, National Insurance, and pension deductions is complex. PAYE software UK simplifies these critical tasks. It ensures your business remains compliant. Choosing the right solution is paramount. This guide explores everything you need. It helps you make an informed decision.

The Foundation of UK Payroll

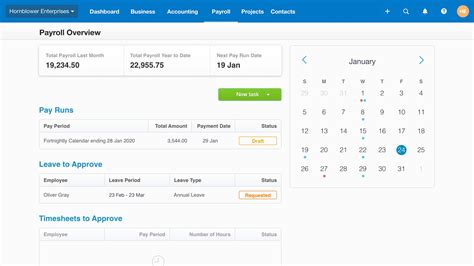

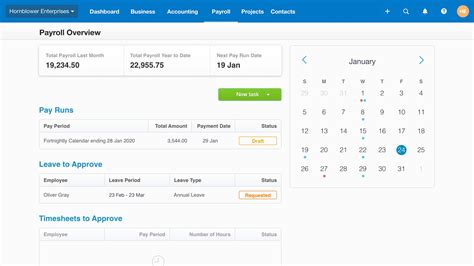

PAYE stands for Pay As You Earn. It is HMRC’s system. Employers deduct tax from employee wages. National Insurance contributions are also included. Pensions often fall under this too. Accurate, timely submissions are mandatory. Failing to comply brings heavy penalties. Manual payroll processes are prone to errors. They consume valuable time. PAYE software UK automates these calculations. It streamlines the entire process. This ensures compliance every single time.

Why Modern Businesses Rely on PAYE Software UK

Modern businesses face many challenges. Payroll should not be one of them. PAYE software UK offers crucial advantages. It transforms payroll management.

Compliance is Paramount

HMRC rules frequently change. Keeping up can be difficult. Good PAYE software UK updates automatically. This ensures you are always compliant. It prevents costly penalties easily. Real Time Information (RTI) submissions are vital. Software handles these with ease. This saves countless hours of stress.

Efficiency Gains Are Huge

Manual payroll is time-consuming. It involves repetitive calculations. Software automates these tasks. It calculates tax and NI fast. Data entry is greatly reduced. This frees up valuable staff time. Employees can focus on core business. Small businesses see immediate benefits. Their operational efficiency skyrockets.

Accuracy is Guaranteed

Human error is a significant risk. Mistakes in payroll are costly. PAYE software UK eliminates these errors. It ensures correct deductions always. Accurate payslips are produced effortlessly. This builds employee trust and confidence. Dispute resolution becomes simpler.

Data Security Matters

Payroll data is highly sensitive. It contains personal financial details. Robust software protects this information. Cloud-based options offer strong security. They use encryption and secure servers. GDPR compliance is often built-in. This safeguards your business and staff.

Integration Possibilities

Many PAYE software UK solutions integrate. They link with accounting software. This creates a unified financial system. It streamlines reporting processes. You gain a holistic view of finances. Better business insights emerge. This versatility is incredibly powerful. [See also: Benefits of Integrated Business Software]

Key Features to Look for in PAYE Software UK

Choosing the right software needs careful thought. Certain features are non-negotiable. Look for these functionalities.

- Automated Calculations: The software must handle tax. It needs to calculate NI. Student loan deductions are vital. Statutory sick pay (SSP) is another. Maternity/paternity pay calculation is crucial.

- RTI Submissions: Real Time Information is mandatory. The software should submit directly to HMRC. This ensures full compliance. It helps avoid any fines.

- Payslip Generation: Professional payslips are expected. Digital distribution options are convenient. Employee self-service portals are a bonus. They reduce administrative burden greatly.

- Reporting Tools: Detailed payroll reports are essential. Cost analysis features aid planning. They help identify spending trends. This supports better financial decisions.

- HMRC Recognised: Always verify this status. HMRC recognition ensures compatibility. It guarantees reliability and accuracy. This prevents future headaches.

- Scalability: Your business will grow. The software should grow with it. It must handle more employees easily. Flexible pricing models are a plus. Future-proof your investment now.

- User Experience (UX): An intuitive interface is key. It should be easy to learn. Good customer support is invaluable. This saves training time and frustration.

Choosing the Right PAYE Software UK for Your Business

The market offers many choices. Finding the perfect fit takes effort. Follow these practical steps.

Assess Your Needs

Start by evaluating your business. How many employees do you have? What is your budget constraint? Do you need specific integrations? Consider any industry-specific payroll needs. A clear understanding helps narrow options.

Research Options Thoroughly

Explore different providers. Read online reviews carefully. Compare feature sets side-by-side. Many offer free trials. Take advantage of these trials. Test drive the systems fully. See which PAYE software UK feels right.

Consider Cloud vs. Desktop

Cloud software offers flexibility. Access your payroll anywhere. Desktop software might be cheaper upfront. Security aspects differ between them. Cloud PAYE software UK is gaining popularity. It often provides better scalability.

Support and Training

Reliable customer service is paramount. Check availability and channels. Online resources are very helpful. Initial setup support is often crucial. Ongoing assistance proves vital later. A strong support system is a must.

Future-Proofing

Think long-term about your choice. Will the software grow with you? Does it adapt to future regulations? Investing wisely now saves money later. Choose a solution that evolves.

Conclusion A Smarter Approach to Payroll

PAYE software UK is no longer a luxury. It is an indispensable business tool. It streamlines complex payroll tasks. It ensures full regulatory compliance. This boosts overall operational efficiency. Investing in quality software truly pays off. Protect your business from errors. Empower your team with efficiency. Make informed decisions today. Your payroll process will thank you. Embrace a smarter approach.