Payroll Software UK Navigating Modern Business Demands

Payroll Software UK Navigating Modern Business Demands

Running a business in the UK presents unique challenges. Managing employee payroll is one critical area. It demands precision and compliance. Manual processes often lead to errors. They also consume valuable time. This is where payroll software UK becomes indispensable. It transforms how businesses handle salaries. It ensures accuracy and efficiency. This article explores its vital role. We will discuss its benefits for UK companies. Find out how it can streamline your operations.

The Evolving Landscape of UK Payroll

Payroll used to be a daunting task. Mountains of paperwork were common. Manual calculations were error-prone. UK businesses faced constant compliance risks. HMRC regulations are complex. They change frequently. National Insurance contributions vary. Tax codes require careful application. Pensions auto-enrolment adds another layer. Small businesses often struggled most. Their resources were limited. This created immense pressure. Many spent countless hours on payroll. This time could be spent growing their business. The need for a better system grew. Technology offered a clear solution.

Today, the landscape is different. Digital transformation is key. Cloud computing changed everything. Businesses now seek smarter solutions. They want efficiency and accuracy. They demand compliance built-in. This shift highlights the value. Modern payroll software UK is the answer. It addresses these evolving demands directly. It simplifies complex processes. It empowers businesses of all sizes.

Understanding Payroll Software UK Key Features and Benefits

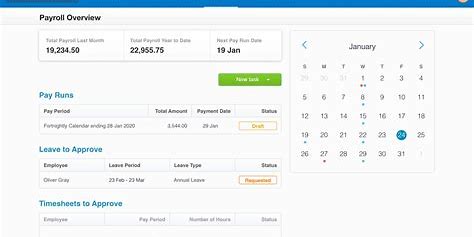

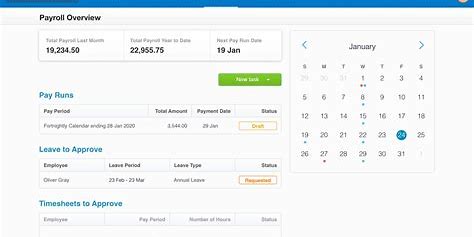

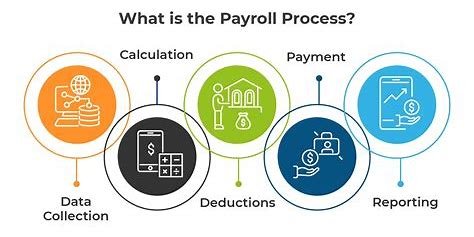

What exactly does payroll software UK offer? It is more than just a calculator. It is a comprehensive management tool. It handles every aspect of payroll. From salary calculations to tax filings. It automates repetitive tasks. This frees up crucial resources. Consider its core functionalities. They provide significant advantages.

Automated Calculations and Compliance

Accuracy is paramount in payroll. Mistakes can be costly. They lead to fines from HMRC. They damage employee morale. Payroll software automates calculations. It applies correct tax codes. It handles National Insurance. Pension contributions are managed seamlessly. It stays updated with legislation. This ensures constant compliance. Businesses avoid costly penalties. Peace of mind is a major benefit. This automation saves tremendous time. It reduces human error significantly.

Integrated Reporting and Analytics

Understanding payroll data is crucial. Software provides detailed reports. These reports offer valuable insights. You can track labor costs easily. You can monitor tax liabilities. Management gets a clear financial picture. Data-driven decisions become possible. HMRC submissions are also simplified. The software generates required forms. It facilitates direct online filing. This streamlines administrative burdens. It enhances transparency across the board.

Employee Self-Service Portals

Modern solutions offer self-service. Employees can access payslips online. They can update personal details. They can view holiday entitlements. This reduces HR queries. It empowers employees with information. It improves overall efficiency. HR teams focus on strategic tasks. This feature enhances employee experience. It fosters greater trust and convenience.

Scalability and Integration

Businesses grow and evolve. Their payroll needs change. Good payroll software UK scales with them. It handles increasing employee numbers. It adapts to new business structures. Many solutions integrate with other systems. Accounting software integration is common. HR management systems also connect. This creates a unified data flow. It prevents data silos. It ensures consistent information. This holistic approach is highly valuable.

Choosing the Right Payroll Software UK for Your Business

Selecting the ideal payroll software UK requires thought. Many options exist. Each has different features. Your business needs are unique. Consider several key factors. Make an informed decision.

Assess Your Specific Business Needs

Start by evaluating your current processes. How many employees do you have? Are contractors involved? Do you offer complex benefits? What is your budget for software? Do you need advanced reporting? List your essential requirements. This forms your selection criteria. It narrows down the choices effectively.

Research and Compare Providers

Many reputable providers exist. Look for UK-specific solutions. Check their compliance record. Read customer reviews carefully. Compare pricing models. Some charge per employee. Others have tiered subscriptions. Request demos from top contenders. See the software in action. Test its user-friendliness yourself. [See also: Top Payroll Software Providers for Small Businesses]

Consider User Experience and Support

The software must be intuitive. Your team needs to use it easily. Complex interfaces cause frustration. Good customer support is vital. You will have questions occasionally. Fast, knowledgeable help is essential. Check available support channels. Phone, email, and chat are common. A strong support system is key. It ensures smooth operation always.

Data Security and Cloud Benefits

Payroll data is highly sensitive. Security must be top-tier. Ensure strong encryption protocols. Check data protection compliance. Cloud-based solutions offer flexibility. Access payroll from anywhere. Remote work is easily supported. Data backups are often automatic. This adds another layer of security. It reduces your IT burden.

Practical Steps for Implementing New Payroll Software UK

Implementing new software can seem daunting. A structured approach ensures success. Follow these steps for a smooth transition.

- Step 1: Data Migration Planning. Gather all existing payroll data. Clean up any inconsistencies. Plan how to transfer it. Ensure accuracy during migration.

- Step 2: Training Your Team. Provide comprehensive training. Users need to understand the system. Offer ongoing support sessions. Encourage active participation.

- Step 3: Phased Rollout (if applicable). Consider a pilot program. Test with a small group first. Address issues before full launch. This minimizes disruption.

- Step 4: Regular Review and Optimisation. Monitor performance continuously. Seek feedback from users. Adjust settings as needed. Maximize software efficiency.

The Future of Payroll Management

The world of work keeps changing. Payroll software UK evolves with it. Artificial intelligence plays a growing role. AI can predict staffing needs. It can detect payroll anomalies. Machine learning enhances accuracy. Mobile access is becoming standard. Employees manage more on their phones. Real-time payments are emerging. Instant wage access is gaining traction. The future promises even greater automation. It will bring deeper insights. Payroll will become more strategic. It will empower businesses further. Staying updated is crucial. Embrace these technological advances.

Conclusion Navigating Success with Payroll Software UK

Managing payroll effectively is non-negotiable. It impacts finances and morale. Manual methods are no longer sustainable. Modern payroll software UK offers a lifeline. It brings accuracy, efficiency, and compliance. It frees businesses to innovate. It allows them to focus on growth. Choosing the right solution is a strategic move. It is an investment in your company’s future. Empower your team with the best tools. Ensure your business remains compliant. Drive operational excellence daily. Embrace the power of digital payroll. Your success depends on it. Future-proof your operations now. Unlock new levels of productivity.