UK Accounting Software Choices That Transform Your Business

UK Accounting Software Choices That Transform Your Business

Running a business in the UK presents unique challenges. Managing finances is a core responsibility. Many businesses struggle with outdated methods. Manual bookkeeping can be slow and error-prone. This is where modern accounting software in UK becomes essential. It streamlines financial operations. It ensures compliance with HMRC rules. Choosing the right platform is crucial for growth. This article explores top options. It guides businesses through this vital decision. We discuss key features and benefits. Understanding your needs is the first step. Digital tools offer significant advantages. They save time and reduce stress. Let’s dive into the world of digital finance.

The Shifting Landscape of UK Business Finance

The UK financial landscape is dynamic. Businesses face constant evolution. Government initiatives drive change. Making Tax Digital (MTD) is a prime example. This mandate requires digital record-keeping. It impacts VAT-registered businesses. Soon, it will affect others too. Compliance is no longer optional. It is a legal necessity. Small businesses often feel the pressure. They need robust solutions. An effective accounting software in UK is vital. It ensures MTD compliance effortlessly. This shift has pushed many online. Cloud-based platforms are now standard. They offer flexibility and accessibility. Business owners can manage finances anywhere. This mobility is a huge benefit. It suits today’s busy entrepreneurs. Traditional methods are fading fast. Digital transformation is key for survival.

Understanding Modern Accounting Software in UK

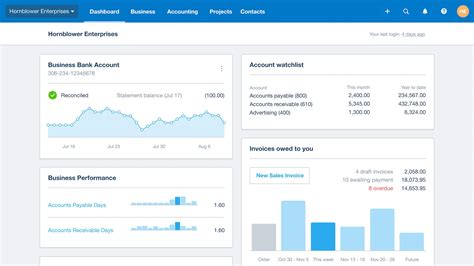

What exactly does modern accounting software in UK offer? It goes beyond simple ledger entries. These platforms are comprehensive financial hubs. They automate many tedious tasks. Think invoicing, expense tracking, and payroll. Bank reconciliation becomes almost instant. Detailed financial reports are generated quickly. These reports offer valuable insights. Business owners can make informed decisions. Cash flow management improves significantly. Forecasting future performance is easier. The software integrates with other tools. This creates a unified business ecosystem. It can connect with CRM systems. E-commerce platforms also link seamlessly. This reduces manual data entry. It minimizes human error. The benefits are clear and tangible. Efficiency gains are often dramatic.

Key Features Defining Top UK Accounting Software

Selecting the right accounting software in UK requires understanding features. Not all software is created equal. Businesses have diverse requirements. Here are some non-negotiable functionalities:

- Invoicing and Billing: Create professional invoices. Send them automatically. Track payment statuses.

- Expense Management: Record business expenses easily. Categorise them for tax purposes. Attach receipts digitally.

- Bank Reconciliation: Connect directly to bank accounts. Match transactions automatically. This saves hours of work.

- Reporting and Analytics: Generate profit and loss statements. View balance sheets. Access cash flow reports.

- Payroll Integration: Manage employee salaries. Handle PAYE and National Insurance. Ensure HMRC compliance.

- Multi-currency Support: Essential for international trade. Handle different currencies smoothly. Track exchange rates.

- Making Tax Digital (MTD) Compliance: Submit VAT returns directly. Stay compliant with UK tax laws. This is non-negotiable.

- Inventory Management: Track stock levels. Manage purchases and sales. Important for retail businesses.

- Project Accounting: Monitor costs and revenues per project. Useful for service-based companies.

- User Access Control: Grant different access levels. Protect sensitive financial data. Collaborate securely.

Each feature adds distinct value. Consider your specific operational needs. A freelancer needs different tools. A growing SME has more complex demands. The best software scales with you. It supports your business journey.

Cloud vs. Desktop: The Dominance of Online Solutions

The debate between cloud and desktop is largely settled. Cloud-based accounting software in UK dominates. Desktop solutions are increasingly niche. Cloud platforms offer unparalleled flexibility. Access your financial data anywhere. All you need is an internet connection. This supports remote working. It enables real-time collaboration. Accountants can access client data remotely. Business owners can check figures on the go. Security is also a major advantage. Cloud providers invest heavily in data protection. They offer robust encryption. Regular backups are standard practice. This protects against data loss. Desktop software requires manual updates. It limits access to one machine. Data security depends on local measures. For most UK businesses, cloud is the future. It is a more secure, flexible choice. [See also: The Future of Cloud Accounting]

Choosing the Best Accounting Software in UK: Practical Steps

The market is flooded with options. How do you pick the right accounting software in UK? A structured approach helps. Avoid impulsive decisions. Your choice impacts long-term efficiency. Consider these practical steps:

- Assess Your Business Size and Type: Are you a freelancer? A small business? A larger enterprise? Each has unique needs.

- Identify Essential Features: List your absolute must-haves. What functions are critical for your operations?

- Consider Your Budget: Software costs vary widely. Many offer monthly subscriptions. Balance features with affordability.

- Evaluate Ease of Use: A complex system causes frustration. Choose intuitive software. Training time should be minimal.

- Check for MTD Compliance: This is non-negotiable for UK businesses. Ensure seamless VAT submissions.

- Read Reviews and Testimonials: Learn from other users’ experiences. Look for UK-specific feedback.

- Utilise Free Trials: Most providers offer trials. Test the software before committing. See if it fits your workflow.

- Look at Integration Capabilities: Does it connect with your other tools? CRM, POS, e-commerce platforms?

- Assess Customer Support: Good support is invaluable. When problems arise, quick help is essential.

- Plan for Scalability: Your business will grow. Can the software grow with you? Will it handle increased transactions?

Making a list of pros and cons is helpful. Compare at least three top contenders. Involve key team members in the decision. Their input is valuable for adoption.

Emerging Trends and Future of Accounting Software in UK

The world of accounting software in UK is ever-evolving. New technologies are constantly emerging. These innovations promise even greater efficiency. Automation is a key trend. Repetitive tasks are being eliminated. AI and machine learning are gaining traction. They can predict cash flow. They identify anomalies and potential fraud. Data entry will become even more streamlined. Voice commands for data input might become common. Integration with other business intelligence tools will deepen. This offers a holistic view of operations. Real-time insights will be standard. Businesses can react faster to market changes. Personalisation is another growing area. Software adapts to specific user preferences. It offers tailored dashboards. The future points towards hyper-efficient systems. These systems will be proactive, not just reactive. Staying updated with these trends is wise. It ensures your business remains competitive. [See also: AI in Business: What You Need to Know]

Conclusion: Empowering Your Business with the Right Digital Partner

Choosing the best accounting software in UK is more than a technical decision. It is a strategic investment. It empowers your business. It frees up valuable time. This time can be spent on growth. It ensures compliance with complex tax rules. It provides clarity into your financial health. The digital transformation is happening now. Businesses ignoring it risk falling behind. Embrace these powerful tools. Evaluate your needs carefully. Test different platforms. Make an informed choice. Your financial future depends on it. A robust accounting system is your silent partner. It supports every step of your journey. It helps navigate economic uncertainties. It builds a stronger, more resilient business. Start your digital finance journey today. Unlock your business’s full potential.