Beyond Spreadsheets: Smart Payroll Software for UK Small Businesses

Beyond Spreadsheets: Smart Payroll Software for UK Small Businesses

Manual payroll can be a headache. For many UK small businesses, it consumes precious time. Errors are costly. Compliance is complex. Payroll software UK small business owners need is a true game-changer. It simplifies everything. This article explores why. It shows how smart payroll benefits your operations. We will dive into specific solutions. It’s time to move beyond manual tasks.

The Intricate World of UK Payroll for Small Businesses

UK payroll presents unique challenges. HMRC requires strict adherence. Real-Time Information (RTI) submissions are mandatory. They must be accurate and timely. Auto-enrolment pensions add another layer. These rules are non-negotiable. Small businesses often lack dedicated HR teams. Owners usually handle everything. This can lead to costly mistakes. Penalties are a real risk. Time spent on payroll means less time for growth. Understanding these pressures is key. Many businesses feel overwhelmed. They need a reliable system. A good payroll software UK small business solution helps. It simplifies complex regulations. It ensures your business stays compliant. This peace of mind is invaluable.

Consider Sarah, who runs a small bakery. Her mornings are busy. Baking fresh bread is her priority. Yet, every month she faces payroll. Calculating hours for five staff. Deducting PAYE and National Insurance. Managing holiday pay requests. It’s a time-consuming task. One mistake could cost her. A late RTI submission means fines. Her current spreadsheet system is fragile. It barely copes with changes. This is a common scenario. Many small businesses struggle. They need a better way. They need efficient payroll software UK small business tools provide. This is where automation steps in. It transforms the process completely.

Transforming Operations with Payroll Software

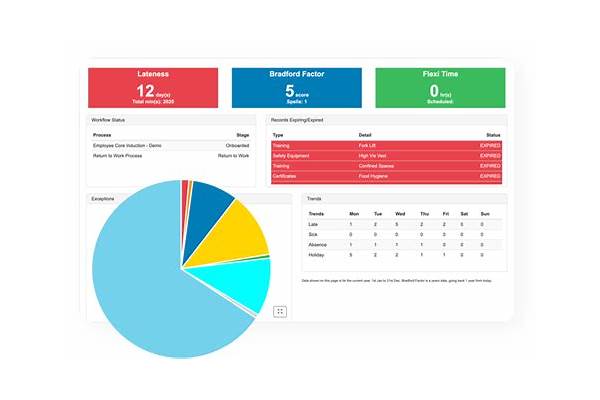

What exactly is payroll software? It automates salary calculations. It handles tax deductions precisely. National Insurance contributions are managed. Student loan repayments are included. Statutory payments are calculated accurately. Think of sick pay or maternity pay. Good payroll software UK small business users rely on does all this. It ensures full compliance. It boosts efficiency significantly. Manual processes are replaced. Digital records are maintained easily. This saves valuable time. It reduces human error potential. Accuracy improves dramatically. Businesses gain peace of mind. They can focus on core activities. This digital transformation is powerful. It modernises your financial operations. It offers robust reporting features. You gain clear insights. Understanding your labour costs becomes simple. This helps with budgeting. It supports strategic business decisions.

Key Features Every Small Business Needs

Choosing the right solution matters. Cloud-based software offers flexibility. Access it anywhere, anytime. Desktop versions provide local control. Consider your business needs first. Scalability is important. Your business might grow. The software should grow with you. Integrations are also crucial. Does it link with accounting software? Xero or QuickBooks are common examples. This streamlines financial reporting. Data flows seamlessly. Think about ease of use. A simple interface is best. Training staff should be easy. Good customer support is vital. These features define top payroll software UK small business providers offer.

Specific UK compliance aspects are critical. The software must handle PAYE correctly. It must manage National Insurance. Student loan deductions are required. Court orders might apply. Statutory Sick Pay (SSP) needs calculation. Statutory Maternity Pay (SMP) also. P45 and P60 forms are essential. End-of-year reporting is simplified. HMRC submissions become automatic. This reduces administrative burden. It frees up management time. Imagine Tom, who runs a small tech startup. He has ambitious growth plans. His team is expanding fast. Manual payroll would quickly become unmanageable. With advanced payroll software UK small business startups thrive. He can add new employees easily. The system handles all complexities. This allows him to focus on innovation. It supports his business expansion plans. [See also: The Benefits of Cloud Accounting for Small Businesses]

Modern trends are also emerging. AI in payroll offers new insights. It can predict future costs. Mobile access is increasingly common. Manage payroll on the go. This offers unparalleled flexibility. Data security is paramount. Ensure your chosen software is robust. Look for strong encryption. Check for regular backups. Compliance with GDPR is mandatory. Your employees’ data is sensitive. Protecting it is your responsibility. Reputable providers prioritise security. They invest in robust infrastructure. This protects your business. It builds trust with your employees.

Practical Steps to Adopting Payroll Software

Adopting new software requires planning. First, research available options thoroughly. Look for reviews and comparisons. Many providers offer free trials. Take advantage of these. Test the software’s features. See if it fits your workflow. Consider your budget carefully. Pricing models vary greatly. Some charge per employee. Others have tiered subscriptions. Ensure it aligns with your finances. Implementation should be smooth. Most providers offer setup guides. Data migration is often supported. Existing employee data can be imported. This saves significant time. It reduces initial workload. Your team needs proper training. Understand the software’s capabilities. Learn how to troubleshoot common issues. Many vendors offer online tutorials. Some provide dedicated support. Utilise these resources fully. Ongoing support is vital. Payroll rules change regularly. Your software must stay updated. Choose a provider with excellent support. They can assist with questions. They help navigate new regulations. This ensures continuous compliance. It keeps your business running smoothly. It is an investment in your future. A reliable payroll software UK small business choice pays dividends.

Securing Your Business Future with Smart Payroll

The journey from manual spreadsheets to automated systems is transformative. For any UK small business, efficient payroll is not optional. It is a necessity. It ensures legal compliance. It enhances operational efficiency. It frees up precious time. This allows you to focus on growth. It boosts employee satisfaction. Accurate and timely payments are crucial. They build trust. They foster a positive work environment. Embrace the digital age confidently. Invest in quality payroll software UK small business owners deserve. The initial effort pays off quickly. You gain peace of mind. Your business becomes more resilient. It is better prepared for growth. It navigates complex regulations easily. Choose wisely, implement effectively. Your business will thank you. The future of small business payroll is here. It is automated, compliant, and smart. Don’t get left behind. Take control of your payroll today. Empower your business for tomorrow’s success. [See also: Maximising Efficiency: Automation Tools for Small Businesses]