Navigating UK Business Finances: Essential Accounting Software Choices

Navigating UK Business Finances: Essential Accounting Software Choices

Running a business in the UK demands precision. Every transaction matters. Managing finances can feel overwhelming. This is where modern accounting software in UK becomes indispensable. It transforms complex tasks. It ensures compliance. It empowers informed decisions. Businesses of all sizes now rely on these digital tools. They streamline operations. They save valuable time. Understanding the best options is crucial for success.

The UK market offers diverse solutions. Each caters to specific needs. Choosing wisely impacts your bottom line. It affects your future growth. This article explores leading choices. It highlights key features. It helps you make a confident selection. We will uncover why robust accounting software in UK is no longer a luxury. It is a fundamental requirement.

The Evolving Landscape of UK Business Finance

The UK economy is dynamic. Businesses face constant change. Regulatory demands are strict. Digital transformation is accelerating. Manual bookkeeping is now outdated. It is prone to errors. It consumes too much time. The shift to digital has been profound. This is especially true for financial management.

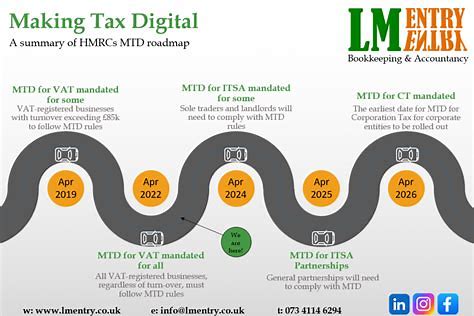

HMRC initiatives drive this change. Making Tax Digital (MTD) is a prime example. MTD mandates digital record-keeping. It requires digital tax submissions. This applies to VAT-registered businesses. Soon it will expand further. Compliance is not optional. It is a legal necessity. Good accounting software in UK ensures this compliance. It simplifies MTD requirements. It keeps businesses on the right side of the law.

Beyond compliance, efficiency is key. Businesses need real-time data. They must understand their cash flow. They need accurate profit and loss statements. Traditional methods struggle here. Digital solutions provide instant insights. They offer powerful reporting. This empowers better strategic planning. [See also: The Impact of MTD on Small Businesses]

The Core of Modern Business: Accounting Software

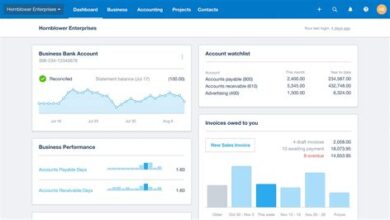

Modern accounting software in UK is more than just a ledger. It is a complete financial ecosystem. It automates repetitive tasks. It reduces human error. It provides a clear financial picture. Consider Sarah, who runs a bustling London design studio. She once spent hours on spreadsheets. Now, her software handles invoicing. It tracks expenses. It reconciles bank accounts automatically. This frees her to focus on design. This is common for many UK businesses.

Understanding Different Software Types

The market offers various types. Cloud-based solutions dominate. They store data online. Access is possible from anywhere. A stable internet connection is all you need. Desktop software still exists. It stores data locally. It offers more control. However, it lacks flexibility. Cloud solutions are generally preferred today. They offer scalability. They provide automatic updates. They enhance collaboration.

Key Features for UK Businesses

Specific features are vital for the UK. VAT management is paramount. The software must calculate VAT correctly. It needs to handle different rates. It must prepare MTD-compliant returns. Payroll integration is another crucial aspect. UK payroll rules are complex. Software should automate PAYE. It must manage National Insurance. It should handle pensions. Multi-currency support is important. Many UK businesses trade internationally. The software must manage foreign transactions. It needs to convert currencies accurately. Bank reconciliation saves hours. Automated feeds directly from your bank. This matches transactions instantly. Robust reporting provides insights. Profit and loss statements are vital. Balance sheets show health. Cash flow forecasts guide decisions. Inventory management helps retailers. Project tracking benefits service providers. These are all essential elements of effective accounting software in UK.

Deep Dive: Cloud vs. Desktop and UK Specifics

The cloud versus desktop debate continues. For most UK businesses, cloud is the winner. It offers unmatched flexibility. You can work from home. You can work from the office. You can access it on your phone. Data is backed up automatically. Security is often higher. Providers invest heavily in protection. Desktop software has its niche. Some prefer local control. They might have specific security needs. However, updates are manual. Collaboration is harder. Cloud solutions truly shine for modern UK enterprises.

Making Tax Digital (MTD) Compliance

MTD is a game-changer. It means digital from start to finish. Your accounting software in UK must be MTD-compliant. It must connect directly to HMRC. It submits your VAT returns seamlessly. This avoids manual input. It eliminates potential errors. Choosing non-compliant software is a risk. It can lead to penalties. Ensure your chosen solution has MTD certification. This is non-negotiable for VAT-registered entities.

Choosing the Right Software for Your Business Size

Small businesses have different needs. They might prioritize ease of use. They need affordable pricing. Solutions like QuickBooks and Xero are popular. They offer robust features. They are user-friendly. Growing businesses need scalability. They require more advanced reporting. They might need departmental tracking. Sage and FreeAgent cater to these needs. Larger enterprises have complex demands. They need extensive integrations. They require advanced customisation. Enterprise resource planning (ERP) systems might be suitable. These integrate all business functions. Your choice of accounting software in UK must align with growth plans.

Expert Outlook: The Future of UK Accounting

The future is automated. Artificial intelligence (AI) will play a bigger role. It will automate data entry. It will identify trends. It will flag anomalies. Machine learning will improve forecasting. This will offer deeper insights. Accountants will become advisors. They will interpret data. They will guide strategic decisions. The best accounting software in UK will incorporate these advancements. Staying updated is key. [See also: The Rise of AI in Financial Management]

Practical Steps to Select Your Accounting Software

Choosing the right accounting software in UK needs careful thought. It is a significant investment. Follow these steps for a smooth process.

- Assess Your Needs: List your priorities. What features are essential? Do you need payroll? Is inventory tracking vital? What is your budget?

- Research Options: Look at popular providers. Read reviews. Compare feature sets. Focus on UK-specific capabilities.

- Consider Scalability: Will the software grow with you? Can it handle increased transactions? Can it add more users?

- Check UK Compliance: Confirm MTD readiness. Ensure it handles VAT accurately. Verify payroll compliance.

- Read User Reviews: Look for honest feedback. Pay attention to customer support comments. Reliability is crucial.

- Utilize Free Trials: Most providers offer trials. Test the software thoroughly. See if it fits your workflow.

- Plan for Training: Ensure your team can use it. Good training resources are important. Support should be readily available.

- Seek Professional Advice: Consult your accountant. They often have preferred systems. Their expertise is invaluable.

Implementing new software takes time. But the long-term benefits are immense. It streamlines your financial operations. It frees up resources. It provides clarity. This helps your business thrive.

Conclusion: Empowering Your UK Business with Smart Accounting

The journey of modern UK business is digital. Effective financial management is non-negotiable. The right accounting software in UK empowers this journey. It simplifies compliance. It boosts efficiency. It provides crucial insights. From solo entrepreneurs to growing enterprises, these tools are transformative. They move businesses beyond manual ledgers. They embrace automation. They ensure accuracy. They prepare for future growth. Making an informed choice now secures your financial future. It allows you to navigate the complexities. It positions your business for sustained success. Invest in the right software. Invest in your business’s future.