Navigating Payroll Simplified: The Power of PAYE Software UK

Navigating Payroll Simplified: The Power of PAYE Software UK

Running a business in the UK demands precision. Payroll is a critical function. Understanding PAYE is essential. PAYE stands for Pay As You Earn. It is the system HMRC uses. Employers collect income tax. They also collect National Insurance. This happens from employees’ wages. Then they pay it to HMRC. The process can be complex. Manual calculations are prone to error. This is where PAYE software UK solutions shine. They streamline payroll operations. They ensure compliance. This article explores their vital role. We will discuss key benefits. We will provide practical insights. Choosing the right PAYE software UK system is crucial. It impacts your business efficiency.

The UK tax system is dynamic. Regulations change frequently. Businesses must stay updated. Failing to comply carries penalties. This creates significant pressure. Many businesses seek robust solutions. They need reliable PAYE software UK tools. These tools automate complex tasks. They reduce administrative burden. They free up valuable time. This time can be spent elsewhere. It can be used for business growth. This is a game-changer for many.

The Intricacies of UK Payroll and PAYE

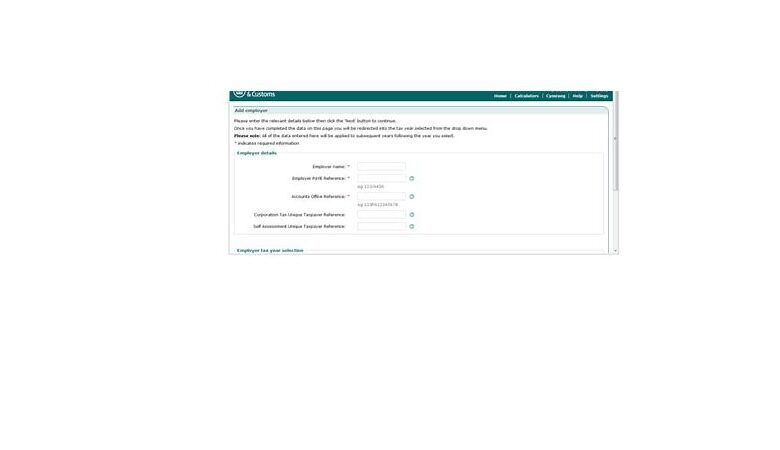

Payroll management involves many steps. Employers must calculate gross pay. They deduct income tax. National Insurance contributions are vital. Student loan repayments are common. Pension contributions are also included. Statutory Sick Pay must be managed. Maternity Pay needs careful handling. Each element has specific rules. HMRC provides detailed guidance. Keeping up is a challenge. Businesses need accurate records. They must submit data on time. This includes Real Time Information (RTI). RTI submissions are mandatory. They happen every payday. Non-compliance leads to fines. This impacts business reputation. It also affects finances. Manual systems often struggle. They cannot keep pace. This makes dedicated PAYE software UK indispensable.

Why Modern PAYE Software UK is a Business Necessity

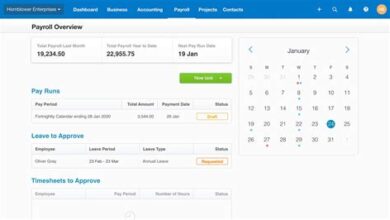

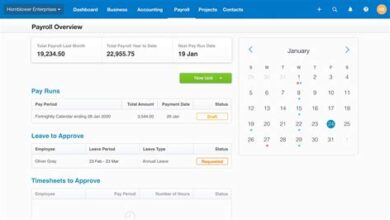

Modern businesses operate at speed. Efficiency is paramount for success. Outdated payroll methods hinder progress. They consume too much time. They introduce human error. Dedicated PAYE software UK transforms this. It automates repetitive tasks. Calculations become instant and accurate. HMRC submissions are simplified. The software integrates seamlessly. It connects with other systems. This includes accounting packages. It offers a complete financial overview. Businesses gain better control. They achieve peace of mind. Compliance becomes straightforward. This is a significant advantage.

Key Features and Benefits

Effective PAYE software UK offers diverse features. These streamline the entire process. Here are some critical components:

- Automated Tax Calculations: The software automatically calculates income tax. It handles National Insurance. It applies correct tax codes. This minimises errors significantly.

- RTI Submissions: It facilitates direct submission. Full Payment Submissions (FPS) are easy. Employer Payment Summaries (EPS) are also simple. These go straight to HMRC.

- Employee Self-Service: Employees can access payslips. They can view P60s. This reduces HR queries. It empowers your workforce.

- Reporting and Analytics: Generate detailed payroll reports. Analyse costs effectively. Plan budgets with confidence. Understand your labour expenses.

- Pension Scheme Integration: It links with pension providers. Auto-enrolment duties are simplified. This ensures compliance with regulations.

- Statutory Payments Management: Calculate SSP, SMP, SPP, SAP, ShPP. This covers all statutory payments. It ensures correct employee entitlements.

- Data Security: Robust security measures protect sensitive data. Employee information remains confidential. This is critical for trust.

Choosing a solution with these features is wise. It ensures comprehensive payroll management. It supports your business growth. [See also: The Future of Payroll: AI and Automation]

Selecting the Best PAYE Software UK Solution

The market offers many options. Finding the right fit is key. Consider your business size. Think about your specific needs. Small businesses might prefer simpler tools. Larger enterprises require more robust systems. Scalability is important. Your chosen software should grow with you. Here are some practical steps:

Evaluate Your Business Needs

Start by assessing your requirements. How many employees do you have? Are your payroll needs complex? Do you need specific integrations? What is your budget? Answering these questions helps narrow choices. This ensures you pick a suitable PAYE software UK product.

Research Reputable Providers

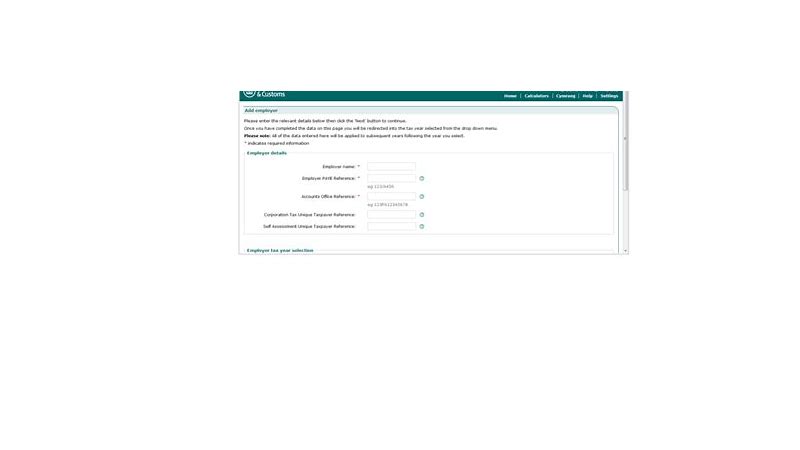

Look for established names. Read reviews from other users. Check for HMRC recognition. Many providers offer free trials. Take advantage of these. Test the software thoroughly. Ensure it meets your expectations.

Consider customer support. Good support is invaluable. When issues arise, quick help is essential. Training resources are also important. They help your team adapt quickly. Smooth implementation is critical. This minimises disruption.

Consider Cloud-Based vs. Desktop

Cloud-based software offers flexibility. Access it from anywhere. Updates are automatic. Desktop software requires installation. It offers more control. However, it needs manual updates. Both have advantages. Choose what suits your operations. Many prefer cloud-based PAYE software UK today. It offers greater accessibility.

Focus on User Experience

The software should be intuitive. Your team needs to use it easily. A clunky interface causes frustration. It leads to errors. Seek out user-friendly designs. Look for clear navigation. This improves productivity. It reduces training time. A good user experience is paramount.

Tips for Seamless PAYE Software UK Implementation

Implementing new software can be daunting. Proper planning ensures a smooth transition. Here are some tips:

- Data Migration: Carefully transfer existing payroll data. Ensure accuracy during this step. Double-check all employee details.

- Training Staff: Provide comprehensive training. Your payroll team needs to be proficient. Offer ongoing support.

- Parallel Run: Run your old and new systems together. Do this for one or two payroll cycles. This helps identify discrepancies. It builds confidence in the new system.

- Regular Updates: Keep your software updated. Providers release compliance updates. These are crucial for HMRC rules.

- Seek Expert Advice: If unsure, consult an accountant. They can offer valuable insights. They can guide your choice of PAYE software UK.

Following these steps will ensure success. Your new system will operate efficiently. It will bring significant benefits.

Conclusion: Embracing Modern Payroll with PAYE Software UK

The landscape of UK business is competitive. Efficiency and compliance are non-negotiable. Manual payroll is a relic. It is inefficient and risky. Modern PAYE software UK offers a clear solution. It automates complex tasks. It ensures HMRC compliance. It frees up valuable resources. It empowers your workforce. Investing in the right software is not an expense. It is a strategic decision. It secures your business’s future. It enhances operational efficiency. It provides peace of mind. Embrace the power of technology. Transform your payroll today. Your business will thank you.