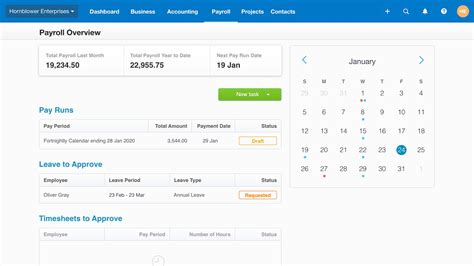

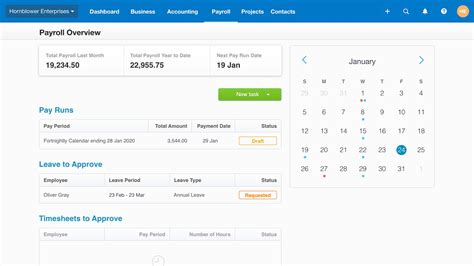

Modern Payroll Software UK Transforms Business Operations

Modern Payroll Software UK Transforms Business Operations

Running a business in the UK demands precision. Managing payroll is a critical task. It impacts staff morale. It affects financial health. Many UK companies still use manual methods. These can be slow. They are prone to errors. This is where payroll software UK becomes essential. It offers a powerful solution. This article explores its impact. We will examine its benefits. We will discuss why every UK business needs it. It is more than just a tool. It is a strategic asset. Embracing digital payroll ensures accuracy. It guarantees compliance. It fosters growth for any enterprise.

The Evolving Landscape of UK Payroll

Payroll has always been complex. UK regulations are particularly strict. Businesses must adhere to HMRC rules. These include PAYE. National Insurance is another factor. Pension auto-enrolment adds layers. Manual processes often struggle. They lead to mistakes. These errors cost time. They also incur fines. Small businesses feel this strain most. Their resources are limited. Large companies face scale issues. Managing hundreds of salaries is tough. The traditional spreadsheet approach falters. It lacks real-time updates. It offers poor security. This historical context highlights a need. A better system is required. Modern payroll software UK fills this gap. It automates calculations. It ensures legal adherence. It simplifies complex tasks. This shift is not optional. It is a necessity for survival. It drives efficiency. It supports business growth.

The Core Benefits of Payroll Software UK

Implementing effective payroll software UK offers many advantages. These benefits span across operations. They touch every aspect of a business. Here, we delve deeper. We explore the transformative power.

Unmatched Efficiency and Accuracy

Manual payroll is time-consuming. Data entry takes hours. Calculations require careful checking. Human error is always present. A single mistake can ripple through. It impacts pay slips. It affects tax filings. Payroll software UK automates these tasks. It calculates salaries instantly. It applies tax codes correctly. National Insurance contributions are precise. Pension deductions are accurate. This automation frees up staff. They can focus on strategic work. Error rates plummet dramatically. Businesses save valuable time. They reduce administrative overhead. This leads to substantial cost savings. Imagine a small business owner. Sarah used to spend days on payroll. Now, her payroll software UK finishes it in hours. This efficiency is a game-changer. [See also: Boosting Productivity with Automation]

Ensuring HMRC Compliance

UK tax laws change often. Staying updated is a challenge. Businesses must submit Real Time Information (RTI). This means reporting payments on or before payday. Non-compliance carries penalties. These fines can be significant. Payroll software UK is built for this. It tracks all regulatory updates. The software automatically adjusts. It ensures all submissions are timely. It guarantees they are accurate. This provides immense peace of mind. Businesses avoid costly errors. They maintain a good standing with HMRC. Consider John, a restaurant owner. He worried about new pension rules. His payroll software UK handled it seamlessly. He never missed a deadline. This compliance shield is invaluable.

Enhanced Data Security and Integrity

Payroll data is highly sensitive. It contains personal information. It includes financial details. Protecting this data is paramount. Manual systems are vulnerable. Paper records can be lost. Spreadsheets lack strong encryption. Cyber threats are a constant risk. Reputable payroll software UK prioritizes security. It uses advanced encryption. It implements robust access controls. Data is stored securely in the cloud. Regular backups prevent loss. This protects employees’ privacy. It safeguards the business reputation. Trust is built on security. Companies can operate with confidence. They know their data is safe.

Empowering Employees with Self-Service

Traditional payroll involves many queries. Employees ask about payslips. They inquire about tax codes. HR teams spend much time responding. This takes away from other duties. Modern payroll software UK includes self-service portals. Employees can access their own data. They view payslips online. They update personal details. They check holiday allowances. This empowers individuals. It reduces HR workload significantly. It fosters transparency. Employees feel more in control. They appreciate the convenience. This feature improves employee satisfaction. It streamlines internal communication. It creates a more efficient workplace.

Selecting the Right Payroll Software UK

Choosing the best payroll software UK requires careful thought. Many options exist. Each has different features. Consider your business needs first.

Key Features to Prioritize

- Automated Tax Calculations: Essential for UK compliance.

- RTI Submissions: Must support direct HMRC reporting.

- Employee Self-Service: Reduces administrative burden.

- Integration Capabilities: Links with accounting or HR systems.

- Cloud-Based Access: For flexibility and remote work.

- Robust Security Measures: Protects sensitive data.

- Detailed Reporting: For financial analysis and auditing.

- Pension Auto-Enrolment: Manages contributions and communications.

Look for user-friendly interfaces. The software should be intuitive. Staff training should be minimal. Good customer support is vital. You will need help sometimes. Choose a provider with excellent reviews. Check their track record. Ensure they specialize in payroll software UK. This guarantees local compliance.

Understanding Cloud vs. On-Premise Solutions

Cloud-based payroll software UK is increasingly popular. It offers accessibility from anywhere. Updates are automatic. IT maintenance is minimal. This reduces upfront costs. It enhances collaboration. On-premise software is installed locally. It offers more control. However, it requires significant IT resources. It needs regular manual updates. For most modern UK businesses, cloud solutions are superior. They provide flexibility. They ensure scalability. They are generally more cost-effective long-term.

Future Trends in Payroll Software UK

The payroll landscape is evolving. Artificial intelligence (AI) is emerging. AI can predict payroll costs. It identifies potential errors. Machine learning enhances fraud detection. Predictive analytics helps with budgeting. Automation will become even more sophisticated. These advancements promise greater efficiency. They offer deeper insights. Staying abreast of these trends is wise. Future-proof your business operations. Invest in adaptable payroll software UK solutions. [See also: The Future of HR Technology]

Practical Steps to Implement Payroll Software UK

Transitioning to new payroll software UK can seem daunting. A structured approach ensures success. Follow these steps for a smooth implementation.

Step 1: Assess Your Specific Needs

Start by evaluating your current process. What are your pain points? How many employees do you have? What is your budget? Do you have complex pay structures? What integrations are crucial? Document these requirements clearly. This forms your selection criteria. It guides your vendor search. It ensures the chosen payroll software UK meets your unique demands.

Step 2: Research and Shortlist Vendors

Explore different providers. Look for UK-specific solutions. Read independent reviews. Check their reputation. Shortlist 3-5 potential vendors. Focus on those with strong UK compliance. Prioritize good customer support. Consider their pricing models. Ask about hidden fees. Transparency is key.

Step 3: Request Demos and Trials

Contact your shortlisted vendors. Request a personalized demonstration. See the payroll software UK in action. Ask specific questions. Test key features. Many providers offer free trials. Take advantage of these. Let your payroll team test the system. Gather their feedback. User experience is critical for adoption.

Step 4: Plan Data Migration

Once you choose a solution, plan data transfer. This involves moving employee data. It includes historical pay information. Ensure data accuracy. Work closely with the vendor. They often provide migration tools. Or they offer assistance. A clean data migration prevents future issues. It ensures a smooth start.

Step 5: Train Your Team

Provide comprehensive training. Your payroll and HR teams need it. Ensure they understand the new system. Familiarize them with workflows. Address any concerns. Ongoing support is important. Make sure they know how to use the payroll software UK effectively. This maximizes your investment. It minimizes disruption.

Step 6: Go Live and Review

Launch the new system. Monitor the first few payroll runs closely. Check for any discrepancies. Gather feedback from users. Be prepared to make adjustments. A post-implementation review helps identify improvements. Celebrate your successful transition. You now have efficient payroll software UK.

Conclusion: Embracing a Smarter Payroll Future

The landscape of UK business is competitive. Efficiency is paramount. Compliance is non-negotiable. Modern payroll software UK is no longer a luxury. It is a fundamental requirement. It streamlines operations. It reduces costly errors. It ensures strict regulatory adherence. It empowers your workforce. Businesses can save time. They can cut costs. They can focus on growth. From small startups to established enterprises, the benefits are clear. Investing in the right payroll software UK solution transforms your financial management. It secures your data. It fosters a more productive work environment. Embrace this digital shift. Secure a smarter, more compliant, and ultimately more successful future for your business. The journey to better payroll starts now.