Smart Payroll Solutions for UK Small Business Growth

Smart Payroll Solutions for UK Small Business Growth

Running a small business in the UK presents many challenges. Managing finances is a significant one. Payroll, in particular, demands precision. It often consumes valuable time. Many entrepreneurs find it complex. This is where payroll software UK small business solutions become indispensable. They offer clarity and efficiency. This article explores their vital role. It explains why smart payroll choices matter. It aims to guide UK small businesses. They can achieve smoother operations. They can unlock true growth potential.

The Intricacies of UK Small Business Payroll

Manual payroll processing can be a nightmare. Especially for UK small businesses. It is prone to errors. It is also incredibly time-consuming. UK regulations add layers of complexity. HMRC compliance is strict. Real Time Information (RTI) submissions are mandatory. Auto-enrolment pensions require careful management. Getting these wrong incurs penalties. It also causes employee dissatisfaction. Small business owners often wear many hats. They handle sales, marketing, and operations. Payroll can feel like a distraction. It takes focus away from core business activities. This burden impacts productivity. It can stifle potential growth. Many businesses struggle to keep up. They need a more robust approach. Manual spreadsheets are no longer sufficient. They lack the necessary safeguards. They cannot keep pace with evolving rules. The need for specialized tools is clear.

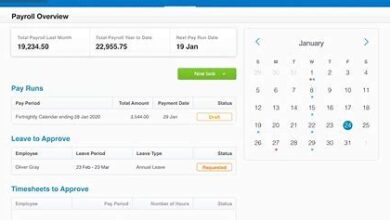

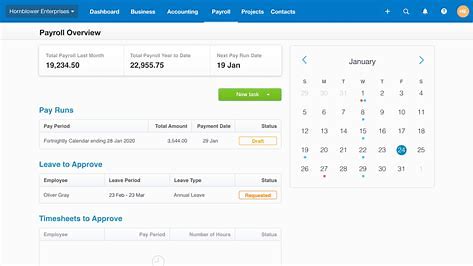

The Power of Modern Payroll Software for UK Small Businesses

Modern payroll software UK small business platforms transform payroll. They automate complex calculations. Tax, National Insurance, and pensions are handled. Deductions are precise. Net pay is accurate every time. This automation saves countless hours. It frees up valuable resources. Accuracy is greatly enhanced. Human error becomes a rarity. Compliance worries diminish significantly. The software stays updated. It reflects current HMRC rules. This ensures legal adherence. Peace of mind is a major benefit. Data security is another key advantage. Reputable software uses strong encryption. Employee data remains protected. This is crucial for GDPR compliance. Integration capabilities are also powerful. Payroll can link with accounting software. This creates a seamless financial ecosystem. This holistic view improves decision-making. It offers a clear financial picture. [See also: Benefits of Cloud Accounting for Small Businesses]

Key Features Every UK Small Business Needs

Choosing the right payroll software UK small business requires careful thought. Several features are non-negotiable. First, HMRC compatibility is essential. The software must support RTI submissions. It should send data directly to HMRC. This ensures compliance with reporting requirements. Second, auto-enrolment support is vital. It must handle pension contributions accurately. It needs to manage employee opt-ins and opt-outs. This simplifies a complex legal obligation. Third, professional payslip generation is a must. Employees need clear, compliant payslips. The software should produce these easily. Fourth, comprehensive reporting is important. Businesses need to track costs. They need to analyze payroll data. Good reports aid financial planning. Fifth, a user-friendly interface is key. Small business owners are busy. They need intuitive software. It should be easy to learn and use. Sixth, scalability is important. The software should grow with your business. It must accommodate more employees. Finally, excellent customer support is invaluable. Help should be readily available. Issues can arise at any time. Reliable support offers quick resolutions.

Real-World Impact: Stories of Transformation

Consider ‘The Daily Loaf,’ a small bakery in Bristol. Sarah, the owner, handled payroll manually. Every month was a scramble. Calculations took hours. She worried constantly about errors. Pension rules confused her. Then, she adopted a payroll software UK small business solution. The change was immediate. Payroll now takes minutes. Calculations are automatic. HMRC submissions are effortless. Sarah no longer fears penalties. She spends more time baking. Her business thrives. Employee morale improved too. Payslips are clear and prompt. This creates trust. It shows professionalism. The software transformed her business. It allowed her to focus on passion. Her customers now enjoy even better bread.

Another example is ‘Tech Solutions Ltd.’ a small IT consultancy in Manchester. They employ a mix of full-time staff and contractors. Manual payroll was a headache. Varied hours and different payment structures complicated things. Their new payroll software UK small business handled it all. It streamlined contractor payments. It accurately tracked diverse working hours. The team felt more confident. Financial reporting became clearer. This insight helped them manage cash flow better. The software became an invaluable tool. It supported their dynamic business model. It fostered efficiency and accuracy.

Choosing and Implementing Your Payroll Software

Selecting the ideal payroll software UK small business requires due diligence. Start by assessing your specific needs. How many employees do you have? What is your budget? Do you need integration with other systems? Research different providers thoroughly. Look at reviews and testimonials. Compare features and pricing plans. Many offer free trials. Take advantage of these. Test the software with your own data. Ensure it meets all your requirements. Consider cloud-based solutions. They offer flexibility and accessibility. Data migration is a crucial step. Plan it carefully. Ensure all employee data transfers correctly. Provide adequate training for staff. Everyone involved must understand the new system. This smooths the transition. It minimizes disruption. Regular reviews are also beneficial. Make sure the software still fits your needs. Business requirements can evolve. The right software adapts with you.

Practical Steps for Seamless Payroll Management

Implementing payroll software UK small business is a journey. It is not a one-time event. First, maintain accurate employee records. This includes personal details. It also covers tax codes and bank accounts. Inaccurate data leads to errors. Second, understand UK payroll regulations. Stay informed about changes. HMRC publishes regular updates. Your software should reflect these. Third, process payroll consistently. Stick to a schedule. This builds employee trust. It avoids payment delays. Fourth, backup your data regularly. Though cloud software handles this, it’s good practice. Ensure data recovery options exist. Fifth, review payroll reports. Look for discrepancies. Analyze trends. Use insights for better planning. Sixth, communicate clearly with employees. Explain any changes. Address their questions promptly. Transparency builds confidence. Finally, leverage software support. Do not hesitate to ask for help. Expert guidance saves time and frustration.

Conclusion: Empowering Growth Through Smart Payroll Choices

The right payroll software UK small business is more than just a tool. It is a strategic asset. It frees up valuable time. It ensures compliance. It boosts accuracy. It provides peace of mind. Small businesses can then focus on what they do best. They can innovate. They can expand. They can serve their customers better. The UK business landscape is competitive. Efficiency is paramount. Embrace modern payroll solutions. They are an investment in your future. They pave the way for sustainable growth. Make this smart choice today. Empower your small business. Unlock its full potential. Secure a brighter financial future. [See also: Understanding UK Tax Obligations for Small Businesses]